Changes afoot for principals of UK appointed representatives in AR regime:

- How new regulation could affect a major distribution channel

- What you can do to prepare

- .…..and how Voyc could help

Background: FCA Consultation Paper 21/34

Appointed representatives (ARs) first arrived on the UK financial services scene over 30 years ago – following the 1986 Financial Services Act.

The AR regime was created to allow firms and self-employed individuals to undertake regulated activities without having to be directly authorised by the regulator. This mainly involves giving regulated advice and selling across a range of financial products – insurance, investments, mortgages and consumer credit.

Each AR is appointed by an authorised firm – called a principal – and conducts regulated business on behalf of that firm. ARs are not employees of the principal but they are covered by the principal’s own regulatory authorisation.

This means that the principal is responsible for the conduct and compliance of each of its ARs with regard to their authorised activities.

The UK regulator (FCA) now believes that the regime as it currently operates poses considerable risks to the fair treatment of customers and that a higher level of regulatory control is needed.

To start this process, the FCA issued a Consultation Paper (CP 21/34) in December 2021.

At the time of writing (March 2022) the deadline for first responses from the industry has just passed.

At the time of writing (March 2022) the deadline for first responses from the industry has just passed.

And we think now is a good time to highlight some considerable changes that could be heading in the direction of UK firms operating through the AR channel – and what those firms can do now to be ready in advance.

Appointed representatives in 2022

Appointed representatives in 2022Today, ARs are a significant part of the UK’s financial distribution landscape.

There are around 40,000 ARs, operating through 3,600 principals. They work across a wide range of financial services markets, including retail lending, retail investments and general insurance and protection.

Over 50% of the 3,600 principals have only one AR each. Others have hundreds, even thousands of ARs. Sometimes these are organised on a network basis, with common elements, such as branding, marketing and systems support.

Since the regime was launched in 1986, two particularly significant trends have developed:

1. Introducer Appointed Representatives (IARs).

The activities of IARs are limited to “lead generation” – introducing potential customers and distributing financial promotions. They do not give advice or arrange sales.

2. Regulatory Hosting.

Principals operating under this model may undertake very little regulated activity themselves. However, they allow individuals and businesses to operate as ARs under their regulatory authorisation.

Unlike a network there is no requirement in the regulatory hosting model for ARs to operate in any kind of similar way or even to distribute the principal’s products or services.

As a result, principals offering regulatory hosting can have a large roster of ARs undertaking a wide range of regulated activities across multiple financial services sectors.

Why is the FCA concerned?

Why is the FCA concerned? Comprehensive analysis of industry data gives the FCA cause for concern about ARs and their principals – as compared with firms not working in the AR regime.

For example, ARs and principals are associated with most (61%) by value of claims paid by the FSCS (Financial Services Compensation Scheme).

Furthermore, complaints per £1m of revenue from regulated activities are consistently and often very markedly, higher for AR principal firms than from non-principal authorised firms.

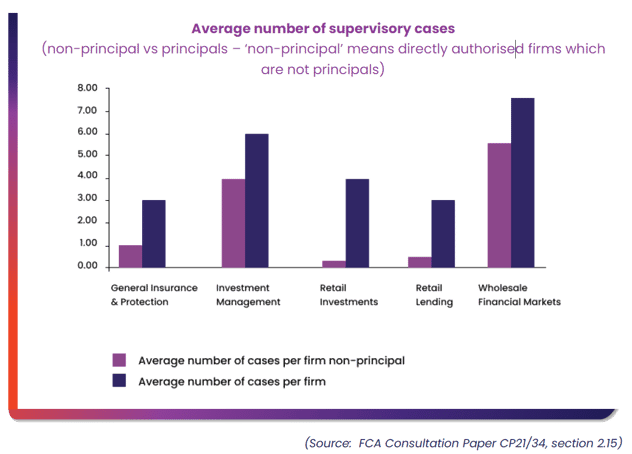

In fact, principals cause 50 to 400% more supervisory cases (cases referred to the FCA’s supervisory teams) than non-principals, as shown in the chart below:

In fact, principals cause 50 to 400% more supervisory cases (cases referred to the FCA’s supervisory teams) than non-principals, as shown in the chart below:

The FCA has found that these worrying figures are often caused by principals not clearly understanding the full extent of their regulatory responsibilities for their ARs.

This leads to insufficient oversight and monitoring of ARs by the principals and inadequate control of their regulated activities.

And all this clearly amounts to potential harm for consumers. For example:

- ARs provide consumers with information that can be misleading or unclear, making it difficult for them to reach the best decision.

- ARs recommend products and services that don’t satisfy the consumer’s current needs.

- ARs act beyond the scope of their agreement with the principal and the activities for which the principal is regulated. On occasions, this can even mean that the consumer has no regulatory redress against the principal.

Moreover, the FCA has identified a particular concern with the regulatory hosting model outlined above.

With regulatory hosting, the range of markets and business models covered by the ARs can be too wide for some principals to oversee effectively. Therefore, the level of control exercised by the principal can be very “light touch” and inadequate.

As a result, the number of FCA supervisory cases per principal operating as a regulatory host is over 3 times the average for principal firms in general.

Impact on vulnerable customers

Impact on vulnerable customersIn developing its consultation paper, the FCA has considered the potential impacts of current practices on different consumer groups – and with particular focus on vulnerable customers.

Customers who are vulnerable are more likely than average to be confused and misled by the kind of practices and behaviours that have led to the current consultation paper.

The FCA is already taking steps to provide additional protection for this group and issued comprehensive guidance to regulated firms in 2021.

You can read more in Voyc’s Vulnerable Customers white paper. We’ve also published a blog post on the new FCA Consumer Duty, which includes important references to vulnerable customers.

What changes could lie ahead?

What changes could lie ahead? Consultation Paper 21/34 focuses on two broad aspects of the current AR regime:

1. Additional information on ARs and notification requirements for principals

Currently, principals are only required to provide the regulator with minimal information on their ARs – including just a high-level overview of the market in which each AR works.

The FCA proposes to strengthen these requirements considerably. Under their proposals, principals will be expected to provide far more information in the future, including:

- details of each AR’s business model and projected revenues;

- a clear statement of the AR activities that the principal is responsible for;

- complaints data for each AR individually.

Principals will also need to provide information that demonstrates full due diligence on any AR prior to their appointment.

All in all, the anticipated new rules will demand that principals demonstrate that they understand their ARs and their business practices.

2. Clarifying and strengthening the responsibilities and expectations of principals

Under this heading, the FCA’s consultation paper sets out a comprehensive range of activities and responsibilities that will be expected of principals under future regulation.

Full details can be found in section 4 of the consultation paper. Some of the more significant measures are as follows:

- Principals should assess the competence and capabilities of the AR’s senior management and ensure that the AR acts within the scope of its appointment. In the case of an IAR, for example, the principal will need to ensure that the activities of the individual or firm do not “drift” into the realm of financial advice. This could perhaps lead to a sharper definition, in the consumer’s eyes, of the distinction between non advised and advised sales of some products.

- Principals should ensure that the activities undertaken by the AR do not present an undue risk of harm to consumers or to market integrity.

- Systems and controls must be set up by principals, to enable them to oversee the activities of their ARs to comparable standards as if the AR were an in-house employee of the principal.

How could this affect principals and ARs?

How could this affect principals and ARs? This update only contains an overview of the scope of the changes that are likely to be included in any regulation resulting from the current consultation. The full consultation paper provides deeper insight.

In our view, some of the measures anticipated could present significant new challenges to many principals – especially in the areas of due diligence and monitoring the activities of their ARs.

It’s also likely that many ARs (including IARs) will experience a marked change in the nature of the business relationships they have with their principals.

At this stage, it’s advisable for all principals and ARs to familiarise themselves with those aspects of the consultation paper that could affect their business operations. After that, they should start the process of planning for what, in our view, could be quite a shake-up in the longstanding AR regime.

How Voyc could help

How Voyc could helpVoyc’s purpose is all about enabling firms to monitor and control the interactions their staff and representatives have with customers on the telephone.

Our software can actively “listen” to and monitor 100% of customer calls made and received. Voyc is programmed and trained to spot words, phrases and issues in calls that represent a quality concern to the user. And when that happens, Voyc instantly sends an alert to individuals designated to deal with the particular matter.

In this way, Voyc enables firms to act immediately on calls that are non-compliant or that suggest or indicate that a customer is not being treated fairly or correctly.

In short, we think Voyc can contribute significantly to the new level of oversight and monitoring of ARs that’s likely to be required of principals as a result of the current consultation.

Voyc is especially suited to operating in centrally managed call centre operations, where numerous agents and representatives are engaged in customer calls of a similar nature. Therefore, we believe that our solution is particularly appropriate to principals with AR network operations – across any number of sites.

It goes without saying that monitoring what’s said to customers on behalf of your firm makes very sound sense.

In fact, the only specific case referenced in CP21/34 concerns a principal who was required to pay almost £400,000 in restitution to customers for failing to exercise adequate control of its ARs selling extended warranty insurance on the telephone.

Some specific concerns highlighted by the FCA is this case were:

- lack of adherence to call centre scripts by ARs which ineffective call monitoring did not identify.

- failure to communicate product benefits and exclusions and non-compliant sales processes on the part of ARs.

- failure by ARs to identify vulnerable customers and act appropriately in response.

“Addressing issues just like these is exactly what Voyc is all about,” comments Matthew Westaway, CEO and Co-founder of Voyc. “We’ve already helped numerous financial services companies to identify and solve similar problems in the call centres”.

“We think the FCA’s new focus on ARs is likely to reinforce the need for effective call monitoring and control across UK financial services. We’re always delighted to have an informal discussion on how Voyc can adapt flexibly to support any operation using telephony to talk to its customers.” Matthew Westaway, CEO and Co-founder of Voyc

How to find out more

How to find out moreFor further information, without obligation, simply contact us here.